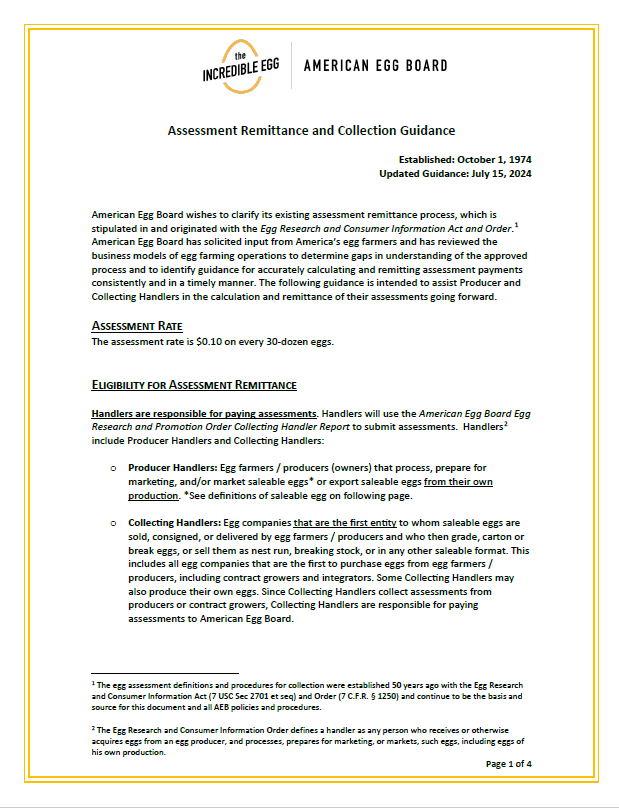

Assessment Remittance and Collection Guidance

Guidance Effective September 1, 2024

American Egg Board (AEB) has created a guidance document to add greater clarity to the Egg Act and Order which governs assessment remittance and originated 50 years ago. This guidance better reflects the business operations of today’s egg farmers and will help ensure the organization fairly and accurately calculates and captures assessments – consistently and in a timely manner.

The Assessment Remittance and Collection Guidance outlines who is responsible to make assessment payments, what qualifies for assessment payments, how to make payments, and the collection process for delinquent payments.

This guidance is effective September 1, 2024.

What You Need to Know

How do I know if my operation is eligible to pay assessments?

Eligibility for assessment remittance is detailed in the Assessment Remittance and Collection Guidance.

What is the Assessment Payment Process?

Assessment payments are due to AEB within 30 days of the previous completed month. Payments are to be made via ACH (preferred) or check (via lockbox). All assessment remittances must be accompanied by a completed assessment form for that remittance to be recorded.

Contact the AEB Finance Team at assessments@aeb.org to switch your payments to ACH.

See Assessment Remittance and Collection Guidance for payment specifics.

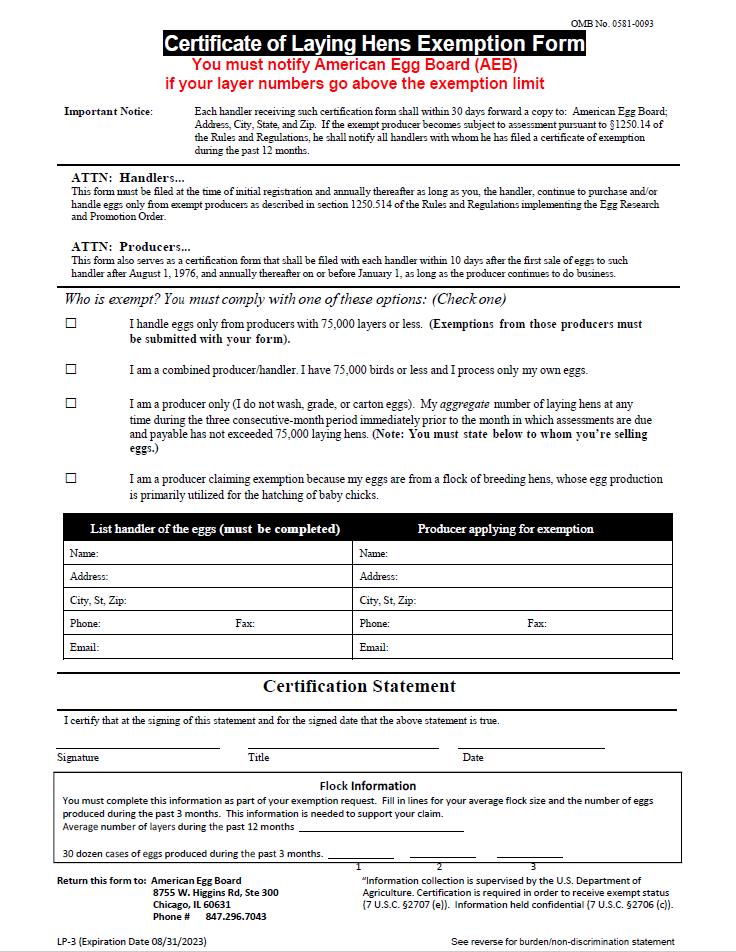

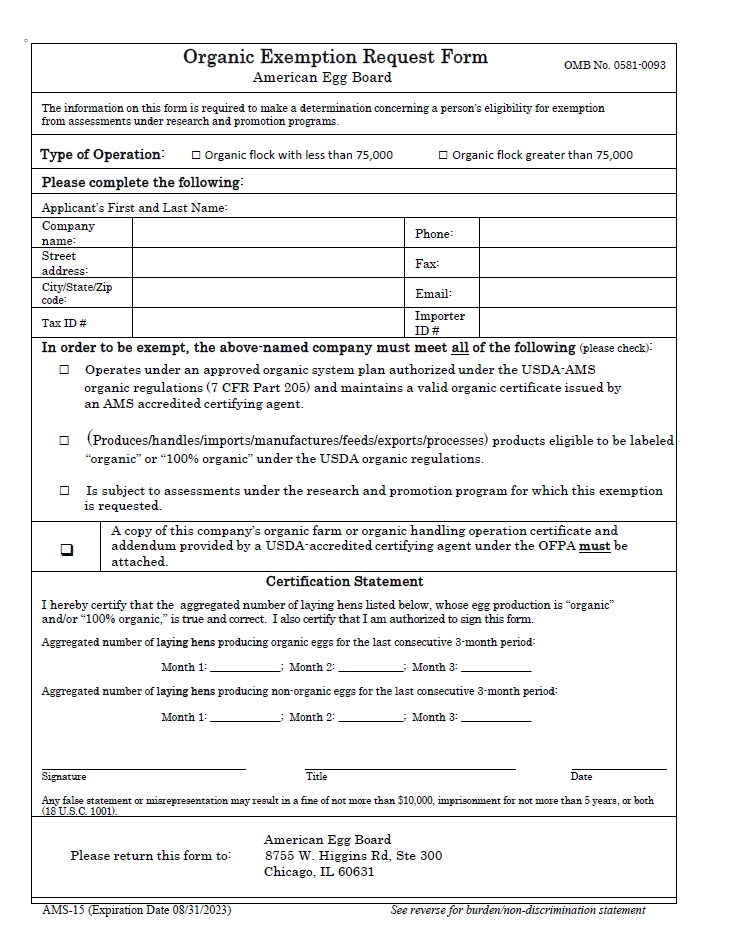

Are Exemption Forms an Annual Requirement?

Yes! The application for exemption is an annual requirement. If the exemption status of your operation has not been previously received by AEB in 2024, Producers have 45 days (until August 31, 2024) to return completed forms – electronically to the AEB Finance Team at assessments@aeb.org.

Starting in 2025, the exemption process will be initiated at the start of each new calendar year with a due date of March 1.

See Assessment Remittance and Collection Guidance for information on eligibility for assessments and exemption submissions.

Charges on Past Due Payments

AEB will actively pursue the collection of interest on past due assessments. See Assessment Remittance and Collection Guidance for more information.

What Immediate Next Steps Should be Taken?

- Review the Assessment Remittance and Collection Guidance and share it with your accounting team.

- Switch payment process to ACH or update mailing address for payment by check

- Submit Exemption Form(s) by Aug. 31 if form(s) haven’t been previously submitted in 2024. Bookmark this landing page as a point of reference.

Questions: Please contact the AEB Finance Team at assessments@aeb.org.